Table of Contents

An era of low-cost financial debt that helped raise rates on resorts, business office buildings and other U.S. professional properties to dizzying new heights has finished.

Bigger financing charges now have been a issue for 2023, with billions of dollars worth of more mature business mortgages coming owing. Incorporating to the woes, best tech titans, together with Meta Platforms

META,

in recent months have retreated from splashy office environment leases.

“You experienced all these huge tech corporations signing significant new leases, which was acquiring the industry relaxed with the idea that the office environment sector was heading to get well about the more time phrase,” reported Greg Handler, head of home finance loan and buyer credit history at Western Asset Administration.

Now, a single of the couple of brights spots in the in close proximity to $21 trillion industrial genuine-estate market place has come to be one more headwind, Handler explained. “It raises authentic queries about who is likely to decide on up that added square feet, and at what price tag.”

Assets puzzle

Insurance policy providers and banking institutions frequently make professional residence financial loans to hold on their guides, while Wall Avenue packages up the debt into bond specials.

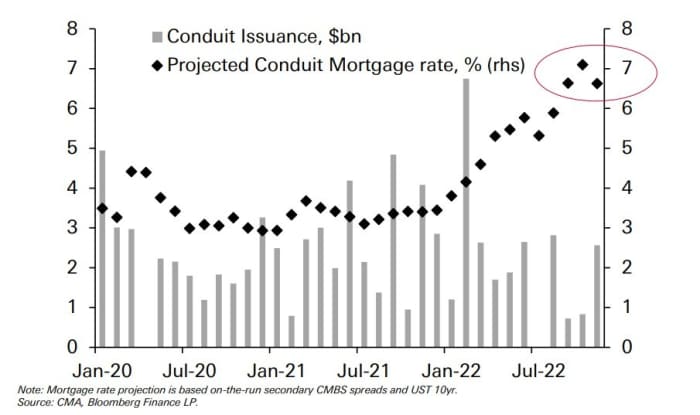

Issuance of bonds, termed business mortgage loan-backed securities, or CMBS, has been a driving force in residence finance for decades. But this year, “conduit” bond issuance backed by a number of debtors and houses collapsed as home finance loan rates topped 7% (see chart), according to Deutsche Bank analysis.

Collapse of a key home funding source

CMA, Bloomberg, Deutsche Financial institution Analysis

Landlords are inclined to default when credit card debt arrives because of and financing dries up, a condition that can be exacerbated when a property’s dollars flows or valuation falls.

Whilst public marketplaces this yr repriced business genuine estate dramatically lower, non-public markets have nevertheless to budge a lot from file degrees, regardless of historic losses in shares, bonds and other economic property.

See: Office-residence woes are driving REIT carnage as 2022 shapes up to be next-worst year on record

The Dow Jones Equity REIT Index

DJDBK,

was on tempo to lose 25% this yr, a even worse drop than the S&P 500 index’s

SPX,

approximately 17% slide, in accordance to FactSet.

“The more substantial issue, I consider, is going to be how do the borrowers refinance,” mentioned Alan Todd, head of CMBS study at BofA World wide. “And which is not just on office environment. It is if you are in a home wherever now valuations are reduced, your price is substantially increased, how are you heading to refinance efficiently?”

What if costs tumble 30%

Industrial property rates cooled slightly in latest months, but still were being up 7.3% on the calendar year through October, according to the RCA CPPI index. What’s much more, selling prices had been an eye-watering 123.5% bigger from 10 a long time ago.

Todd at BofA Global thinks residence charges could fall 20%-30%, then see an uneven recovery. “You’re speaking about a secular, not cyclical, modify for sure residence sorts, no matter whether those people are regional malls or some of the reduce good quality offices,” he stated. “Some of all those could be fairly problematic.”

Even so, Todd doesn’t foresee a deluge of foreclosures, distress or the magnitude of losses that followed the 2007-2008 world-wide economical crisis, given that a lot of creditors now have far more leeway to perform with debtors to wait out the storm.

Borrowers may also tap into equity taken out of attributes to fund tenant enhancements or to get a new financial loan. “We’ve experienced 10 many years of income-out refis, so you gotta believe they have revenue they can dollars in,” Todd said.

Analysts at Morgan Stanley estimate that some $300 billion in “dry powder” also sits on the sidelines, which probably could be deployed and restrict the slide in house price ranges.

Even though, with sales volumes mainly caught in a rut, any buyer striving to estimate wherever assets values may well eventually shake out is using a stab in the dim. The Fed also expects to continue to keep borrowing charges up, until finally inflation finds a crystal clear path down.

“There is an believed $450 billion of loans that arrives owing in each individual of the next 4 yrs,” explained Abundant Hill, head of real estate method and investigate at Cohen & Steers, a actual property-focused investment decision supervisor. “The industry is possessing to occur to the truth that the days of low-priced cash are gone.”

Even now, Hill sees industrial genuine estate heading into 2023 on fairly solid footing, specified prudence from creditors in the past 10 years and his firm’s forecast for net-earnings and earnings advancement to continue being better if the U.S. economic climate sinks into a recession.

“It’s most likely that residence values tumble in the up coming 12 to 24 months,” he said. “But in an surroundings when money flows are great, I really do not feel lenders will provide distressed qualities into a challenging sector.”

More Stories

Why Investors are Flocking to Limassol: A Sea of Opportunities

How Commercial Cleaning Services Impact Your Business’s Success

Harnessing The Power Of Solar Energy For A Cleaner Tomorrow